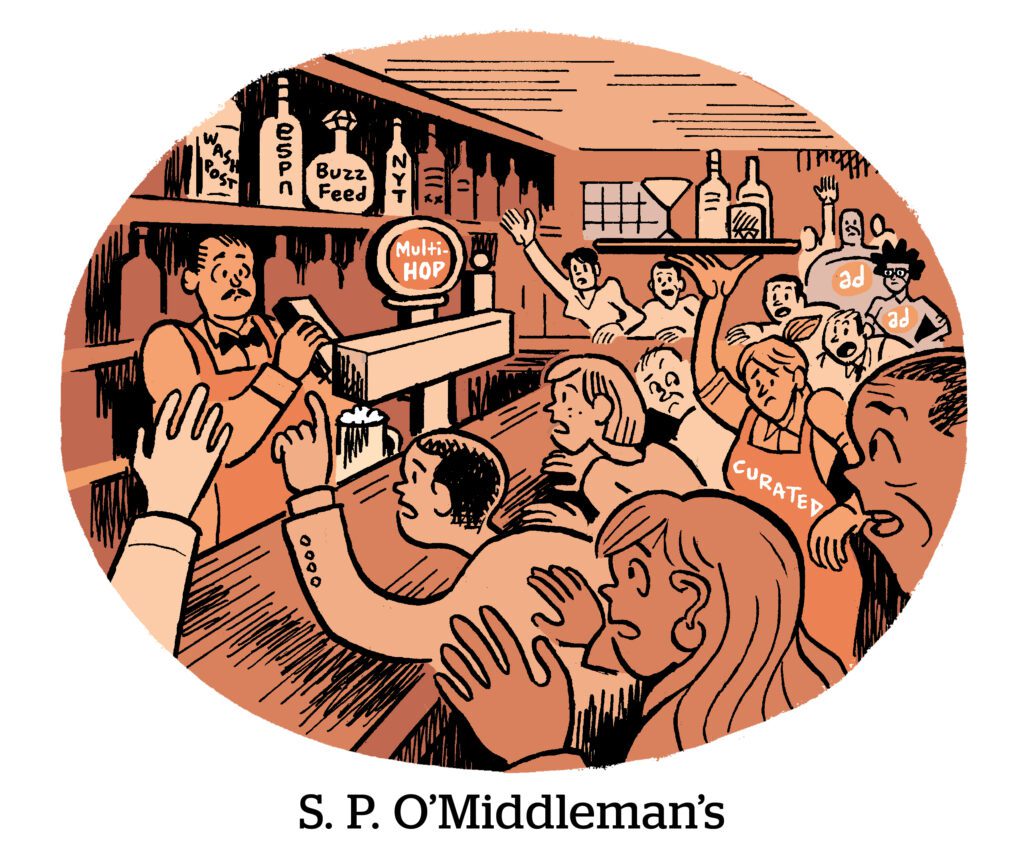

Supply-path optimization (SPO) is nothing new.

But 2023 saw SPO become further cemented in the strategies of DSPs and SSPs for capturing market share. As a result, stakeholders on all sides of the programmatic ecosystem are more SPO-savvy than ever, making these initiatives essential for courting direct business.

Last year, The Trade Desk and GroupM introduced solutions for buying ads directly from publishers – a move seen as encroaching on SSP turf.

This year, SSPs returned fire, as PubMatic and Magnite introduced direct connections with buyers. And after shutting down its SSP, Yahoo’s DSP created its own direct-to-buyer connection.

Clearly, SPO is fueling fiercer competition. And while some of these direct connections are intended for specialized use cases, the long-term trend might see SPO initiatives become the default for programmatic advertisers.

SPO goes mainstream

Whereas SPO may have been the domain of niche vendors and strategies in years past, many DSPs and SSPs are now heavily promoting their SPO products.

As a result, said Nicole Perrin, VP of business intelligence at Advertiser Perceptions, 2023 might have been the year SPO finally became mainstream.

According to research conducted by Advertiser Perceptions in the second half of this year, 39% of programmatic advertisers are now purchasing inventory directly from an SSP – a practice commonly associated with SPO, Perrin said.

According to research conducted by Advertiser Perceptions in the second half of this year, 39% of programmatic advertisers are now purchasing inventory directly from an SSP – a practice commonly associated with SPO, Perrin said.

Concerns about questionable audience extension offerings, invalid traffic and the renewed debate over made-for-advertising (MFA) inventory are pushing SPO into the mainstream, said Jounce Media founder Chris Kane.

The ANA’s June report that revealed MFA gobbles up 15% of annual ad spend is already influencing SPO efforts, Kane said. The percentage of programmatic auctions coming from MFA publishers grew to about 30% before the ANA’s report hit and has dwindled to about 20% since then.

In the past, marketers were more willing to trust programmatic solutions to make data-driven decisions on what inventory to bid on, which may have caused more MFA spending, Kane said. But now, “media buyers have gotten much more confident in making judgment calls about what they’re going to and not going to buy.”

That confidence is manifesting as the increased use of inclusion lists and teams dedicated to avoiding the “ad tech fiasco of the day” by making more proactive buying decisions, Kane said.

Plus, the IAB Tech Lab’s ads.txt 1.1 update is making it easier for buyers to identify sites they want to buy in the programmatic supply chain, Kane said.

Before ads.txt 1.1, there was no way for buyers to easily identify programmatic inventory as being owned by a big publisher like Hearst unless they were already familiar with the many sites it owned, he said. Ads.txt’s introduction of the OWNERDOMAIN and MANAGERDOMAIN fields makes it simple for buyers to find the inventory they want and avoid less-desirable placements.

‘Friendly’ competition

Buyers aren’t the only ones getting more sophisticated when it comes to SPO, as SSPs find ways to be more competitive with DSPs.

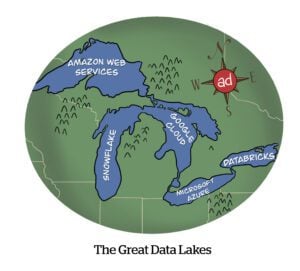

For example, SSPs are investing more heavily in building the types of data marketplaces that have traditionally been the purview of DSPs, and which facilitate audience matching between advertisers and publishers, said Mario Diez, CEO of Peer39.

In the past two months, PubMatic and Magnite have announced data integrations with Experian, and Xandr and Index Exchange have been pursuing similar integrations.

PubMatic and Magnite also launched their own direct connections to the buy side this year. But SSPs focus their direct-buying solutions on video and CTV inventory – and there may be more to that fixation than meets the eye.

PubMatic and Magnite also launched their own direct connections to the buy side this year. But SSPs focus their direct-buying solutions on video and CTV inventory – and there may be more to that fixation than meets the eye.

Programmatic CTV requires server-side header-bidding setups; it’s not compatible with client-side header bidding because that requires a web browser, and CTV refers specifically to streaming video watched on CTV sets, not in browsers.

But if an SSP owns (or has close ties with) a CTV ad server, it can prevent itself from being disintermediated and integrate more directly with publishers.

Magnite, in particular, might see an advantage when it comes to CTV. In 2021, Magnite acquired SpringServe, one of the market leaders in CTV ad serving alongside FreeWheel.

Meanwhile, PubMatic announced a partnership with FreeWheel to support its Activate direct CTV buying solution.

On the other side of the ecosystem, both The Trade Desk’s OpenPath and Yahoo’s Backstage use SpringServe integrations for direct connections to CTV publishers. That suggests DSPs require SSP-owned tech for their SPO solutions that are intended to cut out SSPs – at least when it comes to CTV.

The necessary relationships of these strange bedfellows might be why both DSPs and SSPs have pushed back against the idea that they’re increasingly competing with each other, even though they clearly are.

Indeed, in the programmatic marketplace, “everybody is a partner, and everybody is a competitor,” Jounce’s Kane said. “The winners will be the companies that can navigate some complicated political maneuvering, where you have to build partnerships with companies that want to eat your lunch.”

SPO by default

How those partnerships will continue to influence SPO efforts remains to be seen.

In fact, the SPO market is still in its early stages of evolution, Advertiser Perceptions’ Perrin said. And when it’s all said and done, she added, SPO might influence the way all programmatic buying is done.

SPO solutions are currently productized and promoted under specific names, Perrin said. But it could be the case that, as advertisers use these solutions to connect to the publisher inventory they’re most interested in, DSPs and SSPs will learn from that and make those connections the default for their buying decisions.

The Trade Desk is already moving aggressively in the direction of making the default setting of a campaign ignore huge chunks of inventory it doesn’t think the average buyer is interested in, Kane said. And it’s likely that it and other DSPs will continue along that path for the next year.

So, 2023 may have been the year SPO hit the mainstream, but 2024 might be the year it becomes the new normal.