Snowflake started a snowball rolling in the ad industry two years ago. By now, it’s become a full-fledged avalanche.

On Monday, Snowflake announced its acquisition of Samooha, a startup that develops software to make clean room technology accessible to marketers who aren’t necessarily SQL wizards or data scientists.

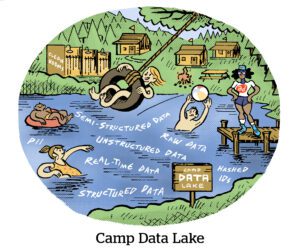

Data clean rooms are well past their initial hype phase, said Samooha co-founder and CEO Kamakshi Sivaramakrishnan. Now, the term “data clean room” and the notion of secure data collaboration have become familiar to people in the industry.

But in terms of applying the technology, there is still what she called “an intangibility” among media and marketing teams accustomed to far simpler software.

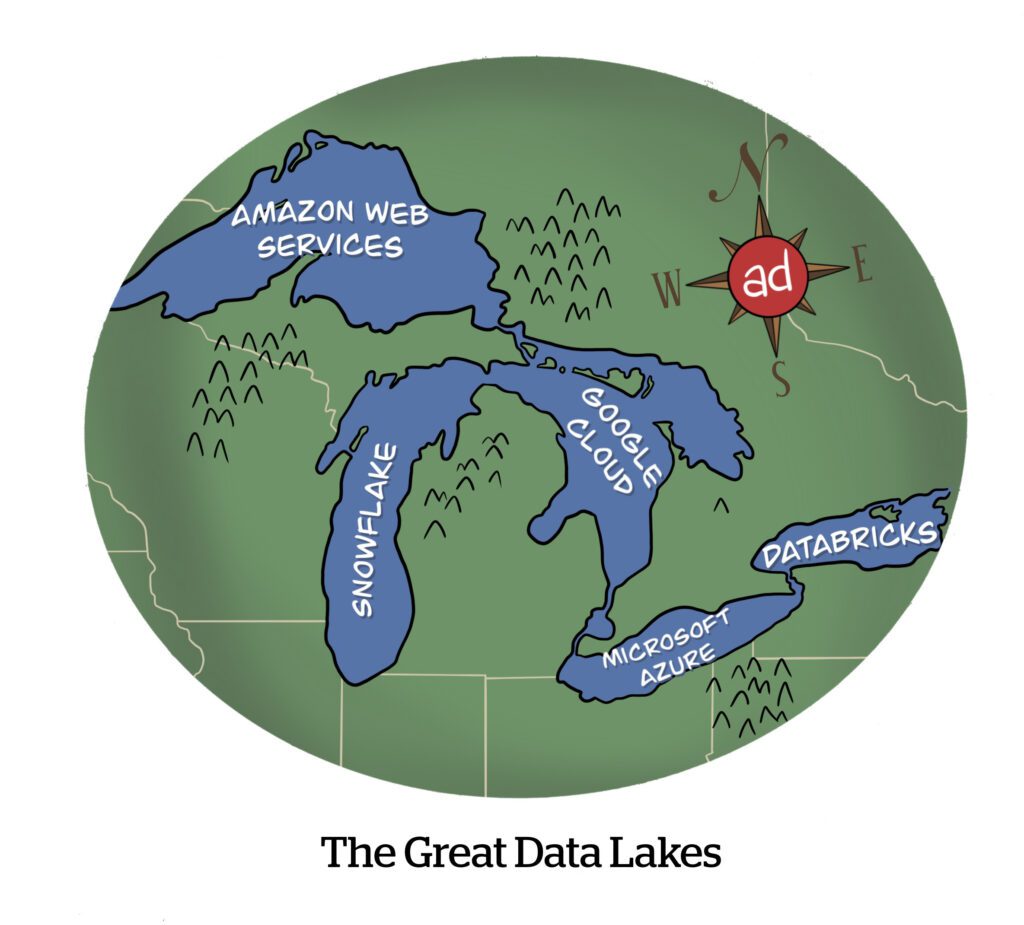

Head in the Clouds

Samooha brings an “big easy button” to the Snowflake clean room product, said Carl Perry, Snowflake’s director of product management.

Media buyers can use Samooha to query their data using plain English prompts.

But aside from simplifying the data science and computer science aspects of a clean room, Samooha also acts as an integration port of sorts between Snowflake and other cloud infrastructure providers. In September, Samooha announced an integration with Amazon Marketing Cloud, the AWS-based clean room product, followed shortly after by a similar integration with Google’s Ads Data Hub.

“From Day One, we’ve known there’s data that customers want to make available in Snowflake, but the data itself is not in Snowflake,” Perry said.

Because marketers pay to transfer their data between clouds, it’s cheaper if the data remains in one place. But both Snowflake and Samooha have a joint vision of allowing companies to work with data wherever it’s stored, Perry said, and being able to simply apply Snowflake’s computing power and product toolkit on top.

The cross-cloud connection

Snowflake was a logical early growth partner for Samooha, founded less than two years ago, according to Sivaramakrishnan.

Although terms of the deal were not disclosed, Snowflake was previously an investor in Samooha, having taken a 25% stake at a $40 million valuation in February. Samooha also brings between 15 and 20 people to Snowflake.

Although Samooha’s ambitions are to move beyond marketing applications, many of its earliest clients are marketers that need data collaboration tools to segment audiences for targeting and campaign attribution.

“There’s a big need in media and advertising, because there are tectonic shifts happening there,” Sivaramakrishnan said.

Snowflake, which is relatively new to media and advertising, has the appetite to tackle this market, she said.

But Snowflake also has big cloud businesses for financial services, retail, healthcare and pharma companies, and that creates a great opportunity for Samooha, according to Sivaramakrishnan.

For instance, one joint Snowflake client in the pharma industry is testing Samooha’s clean room service for a non-marketing use case that involves matching and analyzing patients from across healthcare providers without exposing sensitive patient data.

Similarly, although new privacy laws and regulations impact the ad industry, they also effect other categories, which will turn to products like data clean rooms, Perry said.

“We’re going to see more and more needs across every industry and vertical,” he said. “And Samooha and Snowflake will be able to provide that out of the box.”