The in-game ad market entered 2023 riding a wave of optimism.

Advancements in targeting, measurement and ad verification in 2022 were supposed to have set the stage for a growth spurt in 2023. But the amount of money advertisers spend on in-game ads still lags behind the amount of time audiences spend playing video games.

In the first half of 2023, mobile in-game ad revenue accounted for just 3.9% of total mobile ad spend – up slightly from 3.7% the year before, according to eMarketer. But audiences spent 10.6% of their time on mobile playing video games this year – evidence that a disconnect remains.

Is 2024 the year in-game advertising finally reaches its potential?

Given the deprecation of third-party cookies and the reemergence of contextual targeting, the answer could be yes – so long as game publishers position themselves as a source of premium inventory.

More premium plans

One of the biggest developments last year was the rollout of Roblox’s expanded in-game ad offering, which opened up a rich pocket of premium inventory.

The online gaming platform – which claims to reach 39.9 million daily active users over the age of 13 – introduced a slate of new ad features set to go live this year, including compatibility with in-game video ads and self-serve contextual and age-based targeting for users 17 and up.

The online gaming platform – which claims to reach 39.9 million daily active users over the age of 13 – introduced a slate of new ad features set to go live this year, including compatibility with in-game video ads and self-serve contextual and age-based targeting for users 17 and up.

To sweeten the deal, Roblox emphasized that advertisers don’t need to create a branded experience in its virtual worlds to purchase in-game display and video billboards.

Roblox also previewed its plans for the second half of 2024 to attract more programmatic ad dollars, including partnerships with DSPs, resellers and agencies by Q2 or Q3. Meanwhile, it’s building an ecommerce platform for real-world purchases that could launch by the end of the year.

But although a top mobile gaming platform like Roblox expanding its ad products is a big deal, it doesn’t fully satisfy demand for more premium inventory on major gaming consoles.

That’s why Sony and Microsoft announced plans in 2022 to bring in-game ads to free-to-play PlayStation and Xbox games.

While there weren’t many official updates on that front in 2023, a document leaked as a result of Microsoft’s legal battle with the FTC over its acquisition of Call of Duty publisher Activision Blizzard revealed Microsoft’s ambitions for growing its own in-game ad offering.

According to that document, Microsoft expects its gaming ad revenue to grow from $100 million in 2022 to $1.4 billion by 2030.

Speaking of Microsoft’s Activision Blizzard deal, the $68.7 billion price tag for that acquisition – more than double the $26.2 billion Microsoft paid to acquire LinkedIn in 2016 – goes a long way toward proving the value of video games compared to other media channels, said Jonathon Troughton, CEO of in-game measurement company Frameplay.

Omnichannel campaigns

But many advertisers don’t consider gaming to be of equal value to other media channels, such as CTV and social media.

Despite the popularity of video games, in-game ad campaigns have mostly been limited to experimental budgets and standalone test campaigns. But more advertisers began including in-game ads in their omnichannel media budgets in 2023, and that momentum is likely to continue next year, said Itamar Benedy, CEO of in-game ad platform Anzu.

“We have already begun to see this from the agency side, with many of the big players building out gaming playbooks and setting up deeper integrations and partnerships within the space,” Benedy said. “The effective use of targeting is going to be a key part of this shift.”

The new in-game measurement guidelines published by the IAB and MRC in 2022 finally began to bear some fruit in 2023 by unlocking larger budgets, Benedy added.

And further advancements made last year in targeting, attention measurement, media-quality verification and combatting fraud and invalid traffic will produce more tangible results this year, he said.

DSPs such as The Trade Desk and Microsoft-owned Xandr are also leaning into the gaming space, which is helping lower barriers to adoption on the buy side, Troughton said.

But perhaps most important are the partnerships between in-game ad platforms and verification vendors, like Integral Ad Science, that allow advertisers to compare viewability, completion rates and performance metrics for in-game ads to other channels, said Shahar Sorek, CMO of gaming creator monetization platform Overwolf.

“Campaign metrics such as brand awareness uplift, brand consideration and purchase intent took root across the board in 2023,” he said, “and have helped in-game advertising stand strong in comparison to other industry standard advertising solutions.”

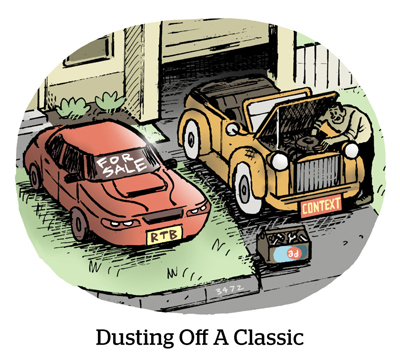

The cookie’s loss is gaming’s gain

There is, however, another tailwind for in-game ads in 2024: The demise of the third-party cookie.

“Gaming was never built upon a cookie solution,” Troughton said, “and modern clean rooms and data spines come natively to intrinsic in-game advertising.”

As targeting signals like cookies are deprecated and IP addresses are no longer available for targeting and measurement due to privacy concerns, advertisers will be drawn to channels where they don’t need to handle private data to target people effectively – including in-game advertising, Benedy said.

Plus, with addressable inventory growing harder to come by, contextual advertising is reemerging as a preferred tactic that will be top of mind for advertisers throughout 2024, Troughton said.

“Having engaging, contextual content on every marketer’s mind,” he said, “will be a huge win for in-game advertising.”