Over the past couple of years, thousands of retail industry trends have been flying around like loose threads.

But, through it all, one fact stands above all other mere trends: to the biggest go the spoils.

And by biggest, I mean the very, very biggest.

Macy’s may seem like a giant. It owns the flagship Herald Square department store, the largest in the world, and is the biggest apparel purveyor aside from fast-fashion app Shein.

I was surprised to discover the retailer was made a buyout offer over the weekend valuing Macy’s at $5.8 billion. Just $5.8 billion. For Macy’s.

But, indeed, that included a billion-dollar premium. To think, Macy’s had a market cap of almost $25 billion in November 2022.

It is one of many retailers that have suffered painful drops during that time, spanning categories and business models.

Zulily, a once-promising online marketplace, is going out of business, per reports this week. Etsy and Wayfair are on life support. Shoe retailer Allbirds traded at $26 per share in November 2022, but is barely above $1 now. Warby Parker is one-sixth its former size. Kroger, Albertsons, Best Buy and Target are barely more than half the size they were in terms of market cap.

Walmart shares, however, reached a new all-time high last month. Amazon, which has a valuation of 1.5 trillion, is in another stratosphere altogether.

The value of scale

One major differentiator for Walmart compared to other large department stores or big-box chains is the growth of its marketplace.

Of course, Walmart still trails far behind Amazon as a third-party marketplace, but the brick-and-mortar giant has 400 million items in its third-party marketplace, according to John Rainey, Walmart EVP and CFO, at the Morgan Stanley Global Consumer and Retail Conference last week.

The marketplace expands Walmart’s reach to new products, sellers and customers. The marketplace and advertising platform are also jointly raising the company’s overall profit margin, Rainey said. The traditional retail profit margin is about 5%, whereas the marketplace sales margins can be between 25% and 50%.

Meanwhile, other retailers are settling – with their marketplaces and ad businesses. They simply don’t have the delivery capability, so most are pushing users to buy-online, pick-up-in-store options.

Meanwhile, other retailers are settling – with their marketplaces and ad businesses. They simply don’t have the delivery capability, so most are pushing users to buy-online, pick-up-in-store options.

That’s all well and good, but the fastest-growing part of Walmart’s ecommerce business is home delivery. Rainey said it is enabled by Walmart’s 4,700 US stores, which collectively are within a 10-mile range of 90% of Americans.

The parts of Walmart’s business that ensure it will have a more “diversified and durable” revenue model two years from now, as Rainey put it, are things other non-Amazon retailers simply don’t have the scale for.

Shopify is one of the few companies that might potentially have aggregated enough scale to match Walmart’s fulfillment, let alone Amazon. But Shopify sold off its fulfillment and logistics business this summer, because it couldn’t sustain the investment in fulfillment and warehouses.

Media flex

Amazon’s and Walmart’s control over shoppers-as-audiences – not to mention their endless resources – is another immense advantage.

The classic is Walmart’s control over pricing. It can simply require brands it carries in stores not to inflate the prices of products in Walmart, even if prices go up elsewhere. But the same is true in the new media realm.

Walmart has an advantageous deal with The Trade Desk to operate as its DSP. And this year it announced strategic and exclusive partnerships with Roku, Snapchat and TikTok, which otherwise wouldn’t open up to outside attribution data.

Amazon flexes even more power. Early this year, Amazon Advertising became the first and only third-party advertiser allowed to buy into Pinterest audiences. Last month, Amazon quietly rolled out similar partnerships with Snapchat, Facebook and Instagram.

Those are massively advantageous deals for Amazon, which maintains 100% control over the payment and customer data – nothing is shared back to the social platforms. The revenue model is in Amazon’s favor, too, because as Amazon Ads improves its efficiency at advertising on social networks it keeps all the ecommerce revenue – it shares no commission or performance incentive with the other walled gardens.

Customers always win

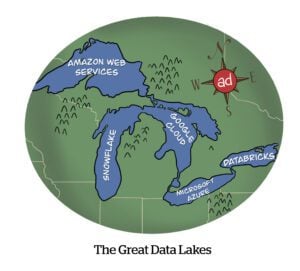

There’s a retail scale gap, similar to how huge digital media publishers – The New York Times, BuzzFeed at its peak, etc. – never even approached the threshold where digital advertising scale really mattered.

Having a super-sized base of shoppers who regularly come to a store, site or app creates a powerful flywheel.

How does Amazon continue to build scale, having reached its current gigantic size and in a potential economic downturn? That was the question from Goldman Sachs analyst Eric Sheridan on Amazon’s recent earnings report.

“In these types of economies, we have fared pretty well in part because we have a number of owned-and-operated properties that have very large volumes that advertisers and brands want to get in front of,” responded Amazon CEO Andy Jassy.

Walmart has hundreds of millions of shoppers at stores and online per month, Rainey said.

“When you think about digital businesses, of a startup in Silicon Valley, you can have a great technology, but the challenge is acquiring customers,” he said. “Why I think Walmart is uniquely positioned to be successful here is we have that.”