This was the year live sports entered the streaming arena in full force, creating a new form of fragmentation in the process.

Media companies have been fighting tooth and nail for the rights to air sports games on streaming platforms as a way to attract more subscribers – particularly younger viewers – who watch sports but won’t pay for cable.

But the result of that escalating competition is a messy patchwork of streaming rights that’s frustrating viewers and confounding advertisers.

Consumers are struggling to keep track of which games are available on which streaming services, and it’s a recipe for churn. As a result, advertisers are still trying to figure out how to allocate ad spend across different platforms and how to measure the performance of those ads.

To maximize profits on sports distribution and ad revenue, the TV industry, including streaming platforms, will have to spend 2024 finding ways to rein in fragmentation-induced chaos.

Streamers dream of sports

For programmers, sports streaming works as a customer acquisition strategy.

Disney, for example, is considering bridging more live ESPN content over to the ESPN+ app to convert more cord-cutters into subscribers and, in turn, attract more advertisers. (ESPN+ has 26 million subscribers and generated more than $16 billion in revenue during Disney’s 2022 fiscal year.)

The demand for livestreamed sports is why so many media companies are working live sports into their streaming platforms.

- Hulu simulcasts a number of NHL games.

- Warner Bros. Discovery-owned Max broadcasts NHL and NBA games and MLB playoffs.

- Amazon touts its $1 billion Thursday Night Football deal as a platform for attracting subscribers and advertisers.

- Paramount and NBCUniversal also cite NFL streams as a main driver of recent sign-ups for Paramount+ and Peacock.

The market opportunity would explain why smaller online streaming platforms keep cropping up left and right for a chance to take advantage of on-demand sports, even if those smaller platforms are left to fight over airing rights for smaller sports leagues, such as pickleball or wiffle ball.

Fazed by fragmentation

But because so many platforms are trying to take advantage of the opportunity in sports livestreaming, people need multiple streaming subscriptions to watch all the games they want to see, even for a single sports league, which is expensive and creates a subpar user experience.

For example, here’s what streaming viewers have to do to catch the full slate of NFL games throughout the current season:

NBCUniversal’s Peacock livestreams Sunday Night Football, while ESPN has the rights to Monday Night Football, and Amazon gets control over Thursday Night Football. Meanwhile, YouTube TV has the NFL Sunday Ticket for out-of-market games that don’t air on local TV stations.

There’s also the NFL+ app, but the app is designed for over-the-top viewing on desktop or mobile, which is not ideal for viewing parties.

Not only do people need deep pockets to watch all this stuff – that’s a lot of different streaming services – they nearly need a PhD to figure out where to see their games.

And subscribers are choosy about what they’re willing to pay for, so even popular sports content isn’t necessarily safe from subscriber churn.

Streaming subscriptions that bundle in live TV are expensive in large part because they include sports content. For example, Hulu’s Live TV package costs a whopping $75.99 per month (not including ESPN+), while YouTube TV costs $72.99 per month. Many consumers consider this a good deal compared to cost-prohibitive cable, but go on to cancel their subscriptions once they realize they don’t actually watch enough live TV to justify these monthly bills. (Check out this Reddit thread as evidence.)

To keep subscribers around, some streaming services are building separate tiers or add-ons for sports content. One example is Max, which is rolling out a sports add-on for $10 per month ahead of March Madness next year.

Measure up

Making highly popular content more accessible from a cost standpoint will reduce cancel rates – in line with how streamers already approach subscriber churn.

But for advertisers, content fragmentation isn’t the only sticky issue with sports livestreams. Programmers also differ in how they approach ad measurement.

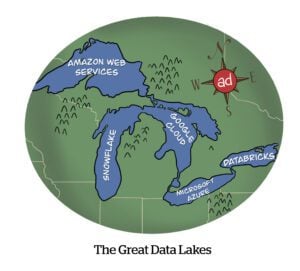

Amazon, for instance, hopes to integrate its first-party streaming data with Nielsen measurement. This plan stalled in the fall when the Media Rating Council declined to vote on whether to audit this ratings product due to intense buy-side backlash. (Agencies don’t like it when media companies try to fuse their own data with that of measurement providers.)

YouTube also intends to bill some of its video inventory based on its own co-viewing numbers, but, like Amazon, had to postpone its plans because of buyer disapproval.

And that’s not even considering differences in how programmers and platforms approach TV measurement from a technical standpoint.

- Amazon and YouTube lean on TV ratings incumbent Nielsen.

- Disney still transacts on Nielsen data but increasingly supports alternative providers, such as VideoAmp, for measurement.

- NBCU is the most vocal of the batch about the need to transact on alternative currencies with more robust viewing data than Nielsen can offer.

But there’s one thing that all advertisers and agencies want, and that’s measurement standardization, which is a painstakingly protracted process. The TV industry has made significant headway throughout this year on improving measurement and vetting non-Nielsen vendors for their viability as currency – but it’s still an ongoing journey.

In the meantime, it’s possible advertisers may keep a hefty chunk of their marketing budgets in traditional TV rather than streaming when it comes to sports. Streaming certainly has a stronger foothold in sports compared with 2022, but right now, linear TV still makes up about 77% of live sports viewing, according to a recent report from Inscape, Vizio’s data science subsidiary.

What I’m wondering is: How much will that gap narrow as a result of improvements in measurement efficacy and consistency throughout 2024?

Let me know what you think. Hit me up at [email protected].