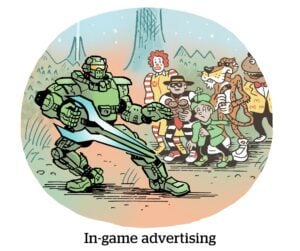

Say hello to ad tech’s latest acronym: CTV OOH (connected TV out of home).

This week, Nexxen (formerly Tremor International) announced an integration with out-of-home ad tech platform Taiv to extend its CTV ad campaigns to TV screens in restaurants and sports bars. Guess what’s old is new again when it comes to marketers using TV as a way to reach as many people as possible.

CTV OOH can “provide additional scale to traditional CTV campaigns,” said John Rogers, VP of global business development at Nexxen. Brands that prioritize one-to-one targeting over reach don’t usually spend much on OOH inventory – although enough scale could be enough to make some advertisers reconsider that stance.

Getting started

Taiv has two sets of clients: venues and advertisers.

The company installs hardware to the TVs mounted in bars and restaurants. This hardware uses AI to detect when a commercial break starts and swaps the active TV input from the content playing to Taiv’s device, effectively replacing a designated commercial break with its own ads.

Venues agree to this setup because they get a cut of the ad revenue, which is net-new income for many brick-and-mortar businesses. But, perhaps more importantly, these spaces can also add their own house ads to the rotation.

Take Mickey Byrne’s Irish Pub in Hollywood, Florida. The bar is seeing an increase in foot traffic and sales as a result of running promos for its own events, such as karaoke nights and happy hours, said Mark Rowe, owner of the bar. The ads are proving more effective than posters, custom beer coasters and other more traditional ways to promote these deals.

According to Rowe, this is because when patrons come to a bar with TVs, “chances are, they’re staring at the TV screen.” (A sales-savvy take, albeit sad for the state of social interactions.)

But despite the benefits, CTV OOH ad tech companies typically have a hard time convincing advertisers to buy in.

CTV OOH is still in its “infancy phase,” said Tony Siconolfi, chief revenue officer at Taiv. And agencies “don’t typically jump” at the opportunity to try new things until they’re persuaded that those things work, he said.

New horizons

Nexxen is selling Taiv’s CTV OOH supply to its clients through private marketplace deals.

From a programmatic standpoint, execution works similarly to CTV in that Nexxen doesn’t use an impression multiplier, Rogers said, referring to the technique OOH ad tech companies normally use to determine how many people likely saw an ad displayed in public.

But Nexxen labels this inventory as CTV OOH (rather than just CTV) to make sure advertisers actually know what they’re getting, even though it’s a harder sell. Ad inventory on TVs in public places often get bundled with traditional CTV supply so marketers buy more of it (albeit unknowingly). Call it the “sorta CTV” phenomenon.

OOH ad delivery is one-to-many, so, compared with plain ol‘ CTV, the targeting is limited. In this case, advertisers can target CTV OOH ads based on broad geolocation (such as by ZIP code or designated market area) and content genre (such as sports or entertainment).

But limited targeting creates a potential silver lining for buyers. Ad prices are much lower than what premium TV inventory typically costs. Taiv’s CPMs on average hover around $15, Siconolfi said, and marketers often pay more than double that to advertise on live sports.

Plus, geotargeting means CTV OOH ads can be more localized, such as for businesses located in certain states, compared to the ads that run in national sports broadcasts or livestreams.

Many of Taiv’s brand clients come from verticals that often advertise during live sports, such as consumer-packaged goods, alcoholic beverages, fast food, travel and auto, Siconolfi said. Clients include PepsiCo, Taco Bell, Verizon and Liquid I.V.

CTV OOH works well for advertisers that want to reach a large audience with some degree of basic targeting. Still, it may not be an obvious choice for brands whose success hinges on strong one-to-one relationships, like direct-to-consumer companies.

What’s next?

Although it’s still too early to say how this integration is performing for Nexxen advertisers, Taiv expects to attract more brands that want reach extension for their streaming ad campaigns.

Taiv plans to expand into other types of venues next year, including retailers.

Mickey Byrne’s is seeing more ads play from bigger national brands compared to when the bar first adopted Taiv’s technology prior to the Nexxen integration – as is also evident from the larger rev-share checks coming in, Rowe said.

Which makes sense.

The more scale there is, Rogers said, the more advertisers will start buying CTV OOH.

Are you enjoying this newsletter? Let me know what you think. Hit me up at [email protected].