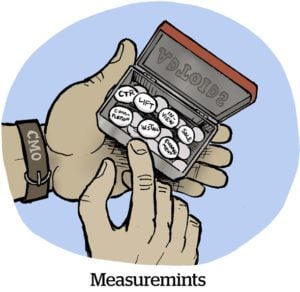

2023 was an eventful year in the land of TV ad measurement.

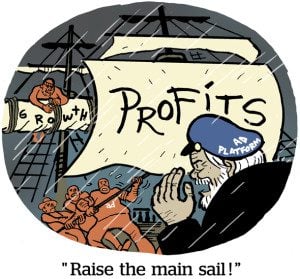

Advertisers have grown to expect more tangible results from their TV and streaming ads, rather than just reach and frequency. Programmers, streaming services and ad tech companies are trying to meet those needs with measurement upgrades.

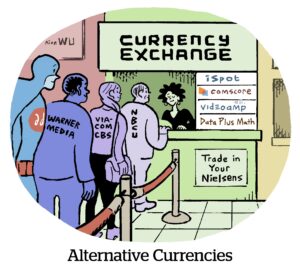

And, of course, the dramatic competition between alternative TV measurement providers intensified this year. Broadcasters formed a joint industry committee (JIC) in January to accelerate the transition to new TV and video currencies, thus widening the divide between the measurement vendors that might become a currency and those that likely won’t – or can’t.

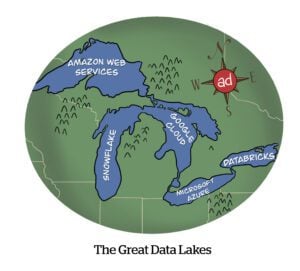

The common denominator of these trends is a burning desire for data to improve the efficacy of TV ad campaigns.

Channeling performance

Media and ad tech companies spent 2023 competing for net-new TV ad dollars by convincing marketers that CTV can, in fact, be a performance channel on par with other digital outlets.

The challenge is that TV historically lacks clear-cut attribution – people don’t navigate around or click on CTV ads, nor do they purchase much via their smart TVs.

But that hasn’t stopped programmers and their measurement partners from trying to bridge that gap.

Over the summer, for example, CTV ad platform tvScientific integrated directly into several affiliate marketing platforms, such as Rakuten and Awin. Advertisers can add CTV spots to their campaigns and use mobile measurement platforms like Adjust or AppsFlyer as performance attributors. To onboard buyers, tvScientific only charges marketers when their campaigns achieve their intended outcomes (like sales, downloads or cost-per-app install metrics).

On the mobile front, app monetization platform Unity signed a similar partnership with Roku in November to integrate Unity’s API with Roku’s ad tech. App advertisers can buy and measure CTV ads alongside search and social. Moving both sets of measurement data closer together also allows agencies to retarget CTV ads on mobile devices as a way to connect that campaign to the CTV spot.

And brands are willing to give CTV a shot.

Achieving the stream dream

Programmers are also improving measurement on their streaming services to persuade advertisers to fully buy into CTV.

The pressure was more intense for streamers that recently introduced ads, namely Netflix and Disney+, which compete against platforms with mature ads businesses and long-running commitments.

In the spirit of CTV performance marketing, Disney named EDO as its preferred partner for outcomes-based measurement ahead of the 2023 upfronts. It also shared plans to support alternative TV measurement providers in upfront deals (for measurement only, though, not as currencies), including VideoAmp and Samba TV.

Throughout the year, Disney has also gradually integrated Hulu’s ad targeting capabilities onto Disney+, which should give buyers the same measurement standards for both platforms.

Meanwhile, Netflix is laser-focused on spiffing up its measurement offerings to quell marketer complaints.

During its first-ever upfront event this year, Netflix announced plans to make Nielsen’s Digital Ad Ratings available to advertisers in Q4 (as in, now), in addition to inking a partnership with EDO. Considering Netflix’s reluctance to venture beyond the safety net of Nielsen measurement, its decision to tap EDO speaks to the degree CTV players need performance-based measurement to survive the streaming wars.

Braving the competition

Speaking of TV measurement providers, those vendors spent the year dueling for status as a go-to currency option.

The JIC forged ahead with plans to certify currencies it believes are ready to be used as a basis for TV ad transactions, starting with conditional certifications for iSpot, VideoAmp and Comscore in September for transparent census-level data.

Nielsen, meanwhile, still refuses to join the JIC – further solidifying Nielsen’s recent positioning as both outsider and incumbent. But, to Nielsen’s credit, it did regain accreditation from the Media Rating Council (MRC) in April for national TV measurement.

Nielsen has suffered from delays, too. Nielsen pushed its timeline to include digital data sets in its endorsed currency (which is still panel-based only). Nielsen also put off its self-imposed deadline of September 2023 to retire its average commercial minute ratings in favor of impressions. That is now set to arrive in Q3 2024. (Talk about a gradual transition.)

The JIC’s certification process also helped distinguish future measurement and currency providers. (Not all measurement providers can become currency.)

For example, Samba TV, Innovid and 605 (which iSpot acquired in September) sit squarely in the measurement camp. One factor that sets measurement vendors apart from currencies is their lack of intention to pursue MRC accreditation for TV audience measurement.

While the JIC says the industry shouldn’t wait around for accreditation to start using new currencies – mainly because MRC accreditation takes forever – the JIC still requires certified currencies to at least pursue an audit from the MRC.

On the other hand, the industry’s top alt currency options – VideoAmp, iSpot and Comscore – busily inked deals with programmers, which makes them stronger contenders for 2024 upfronts. But ad spend behind alt currencies was below optimistic expectations, with the percentage of individual buyers testing or using alt currencies actually dipping by 3% since 2022, according to Advertiser Perceptions.

The process of transitioning to new video currencies is slow, but buyers and sellers are making progress. According to Advertiser Perceptions, roughly 40% of advertisers who tested or used an alt currency this year have eliminated at least one currency from their consideration lists.

And the currency competition will only intensify as contenders drop out of the race, including via consolidation.

Next year, expect the TV measurement shakeout to hit a new fever pitch.