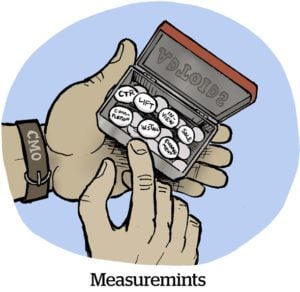

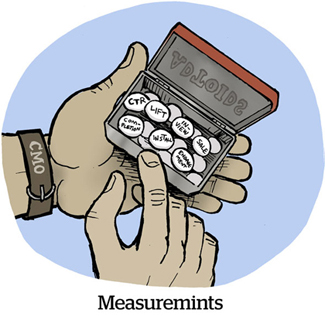

Although the terms “measurement” and “currency” are often used interchangeably in TV land, they’re not the same, and the difference matters.

Measurement is any set of metrics that determine how an ad performs, such as reach, frequency and sales. Currency is the financial unit of value for buying and selling TV ads based on measurement data.

Some forms of measurement, such as reach and frequency, can become a currency when buyers and sellers agree to transact real dollars against it – but not all measurement can make that leap.

This distinction also means measurement and currency require different standards and have different use cases.

“Think of currency as the tip of the measurement iceberg,” said Ramsey McGrory, chief development officer at Mediaocean.

Times are a-changin’

Understanding this contrast didn’t matter much until recently.

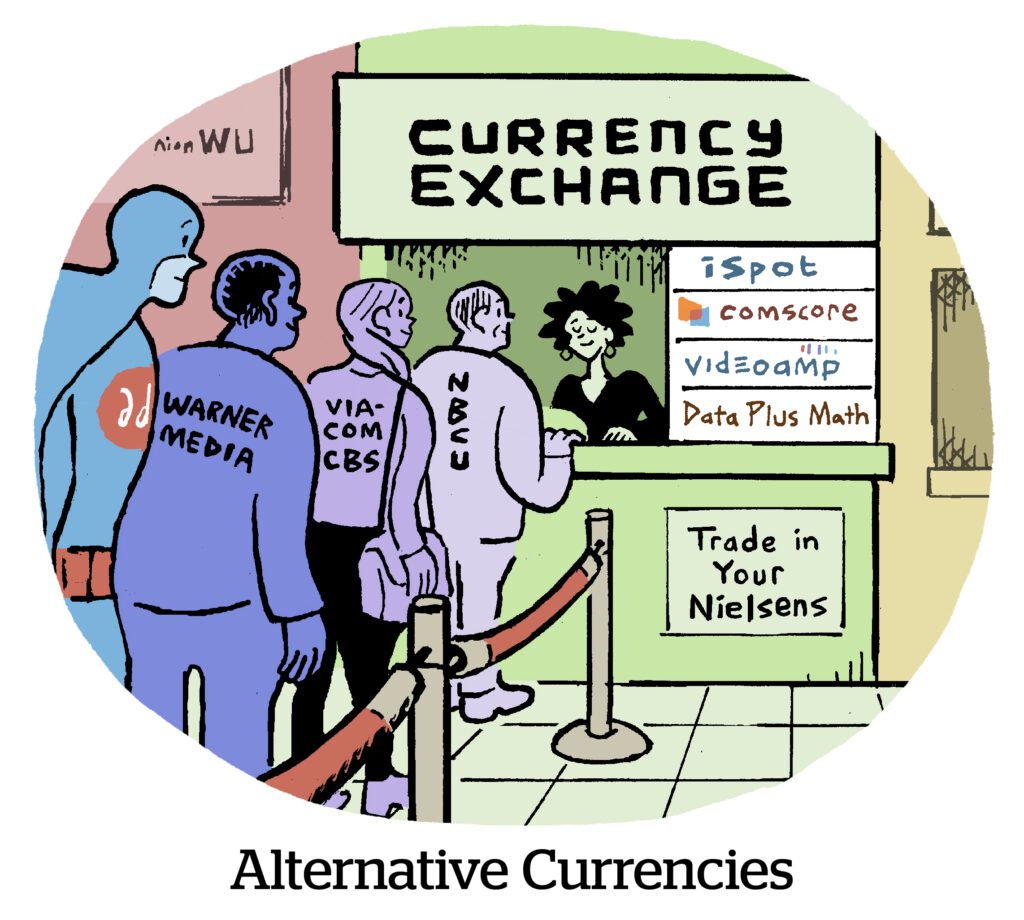

For decades, Nielsen was the only TV currency, and it kept its spot despite the birth of new TV measurement companies over the past decade or so, including VideoAmp, iSpot and Samba. It was only when the century-old incumbent stumbled and undercounted audiences during the pandemic – and lost its national and local TV measurement accreditation from the Media Rating Council (MRC) as a result – that broadcasters and TV advertisers looked to other vendors for a better basis of transaction.

The cries for consistency in TV measurement are only getting louder, which is why a joint industry committee (JIC) of broadcasters formed earlier this year to set standards for new video currencies.

“What started off as a conversation about measurement is now a conversation about currency,” said Helen Katz, EVP of research at Publicis Media.

In mid-April, Nielsen finally won back MRC accreditation for its national TV ratings. (It’s still working on local.) But in the meantime, Nielsen’s throne had been vacant for over a year, and alternative measurement providers used that time to build bridges with broadcasters.

Today, Nielsen is just one of many being considering for currency status.

Now that the industry is looking to crown multiple new video currencies, it’s more important than ever to understand the difference between measurement and currency, Katz said.

Victors in the currency wars will form the basis for billions of dollars in media transactions every year.

What makes a currency?

Measurement is a very broad category. It can include just about any data set that reflects how campaigns perform, ranging from incremental reach and sales to attention and emotions.

Currency, on the other hand, determines how media is priced and therefore must be based on measurement that’s consistent enough to reliably forecast future campaigns. The need for predictability is why the requirements for what constitutes a currency are much higher than for measurement, said David Levy, CEO of OpenAP, the data activation platform behind the new JIC.

This higher level of stringency is also why the JIC is working on standards for new video currencies that evaluate vendors for the stability of their data, namely in counting audiences.

The JIC’s first pass at standards require that currencies use big data sets that are nationally representative, with limited reliance on panels, which are too small to be census representative. According to the JIC’s checklist, any currency that makes campaign projections “representing less than 10% of the universe” must disclose that fact. (No wonder Nielsen disagrees with the JIC – for all its talk about using more big data, Nielsen still relies very heavily on its panels.)

Currency vendors must also provide full transparency into how they deduplicate audiences and what their match rates are. Plus, they should be integrated with Mediaocean and WideOrbit for safe data sharing with programmers and agencies.

Standardization of currency requirements is a necessity for agencies to justify which vendors they’re willing to spend campaign dollars against, Publicis Media’s Katz said.

Measurement mania

Specifically, currency relies on stable audience data that can forecast the reach and frequency of TV campaigns.

Whereas there are multiple forms of measurement that are useful for determining how an ad performed beyond counting impressions, they’re not stable enough to predict future campaigns and therefore don’t make the cut as the basis for a currency.

For example, measuring an audience’s reaction to an ad is much harder to control and thus a lot less predictable, said Jon Watts, managing director of the Coalition for Innovative Media Measurement. In other words, a currency can guarantee that a buyer will reach a specific audience – and even how many times – but it can’t guarantee what action that audience will take as a result.

This lack of predictability is why measurement based on outcomes and attention are just that: measurement, not currency.

Setting standards

But just because measurement alone can’t be used to value media inventory doesn’t mean it can’t be standardized.

The Media Rating Council conducts third-party audits of measurement services to make sure they’re reliable enough for advertisers to use and sets basic standards for measurement, including defining impressions.

Agencies look to the MRC for stability in defining what counts as an impression.

The MRC’s auditing process is rigorous – just look at how long it took Nielsen to win back only a piece of its accreditation – which is why its methodology helped set up the ratings giant as the go-to TV currency for so many decades, said George Ivie, CEO of the MRC.

But the MRC does not crown currency providers. That’s up to the advertising industry.

Operation currency

At this point, the TV ad industry’s need for reliable currency is so dire that it’s largely skipping over MRC accreditation and expediting the process of preparing alternative measurement vendors for real transactions à la the JIC.

The MRC evaluates the measurement process of vendors more intensely than the JIC, according to Ivie. But the JIC is the organization that’s building infrastructure for programmers and agencies to match their own data with that of measurement currencies with plans to use those matches to transact.

Although none of Nielsen’s competitors appear to be prioritizing MRC accreditation, broadcasters aren’t letting that slow down the process.

The JIC is creating its own set of standards and a certification program for new video currencies. Paramount, one of the broadcasters that helped form the JIC, also has a template of its own for how to use them.

Traversing transition

Despite the urgency, however, the industry isn’t ready to transact on non-Nielsen currencies at a comparable scale.

Most programmers are taking tentative steps in that direction, starting with using these new potential currencies as measurement first.

Compared with currency, it’s quicker to start using alt measurement because the stakes are lower. Measurement alone doesn’t directly determine the pricing or value of inventory.

Disney, for example, is using some alt measurement providers for incremental reach and frequency this year – but it’s not actually transacting on those measurement vendors as currency (yet).

From a currency standpoint, “no one can presently deliver an alternative view to Nielsen [that’s equally] inclusive of local [TV viewing],” said Lisa Valentino, EVP of client solutions and addressable enablement at Disney.

The industry shouldn’t be rushing to transact on a currency if its measurement is either incomplete or inaccurate, Valentino added.

Still, Disney, which isn’t yet a part of the JIC, expects the industry to get to a place where it can reasonably transact on a variety of currencies depending on the business needs of clients, such as focusing on advanced audiences, for example, or co-viewing.

Those needs are why Valentino said Disney works directly with more than 100 measurement vendors. Even though Disney isn’t transacting on alt currencies yet, some non-Nielsen vendors will support Disney’s measurement offerings during the upfronts this year, including VideoAmp, Samba and EDO.

The road ahead

Generally speaking, the TV ad industry is still very much in the middle of its transition toward using the most effective of these alt measurement options as currency.

Clients want to be able to buy their ads based on better measurement, not just panel-based ratings, said Kelly Abcarian, EVP of measurement and impact at NBCUniversal.

NBCU is one of many programmers promising buyers the option to transact on non-Nielsen currency during this year’s upfronts. Warner Bros. Discovery and Paramount are doing the same.

The demand for alt currencies will only continue to trend upward, Abcarian said.

“Never [again] should a single [measurement] partner be the only TV currency.”