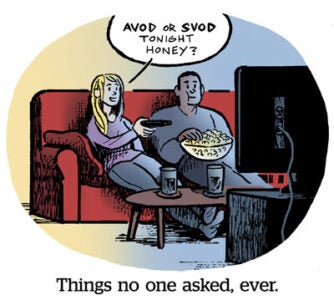

AVOD is the same thing as FAST … right?

Not so fast.

The fragmented TV ecosystem uses a crush of confusing acronyms to describe itself. Their meanings are bleeding into each other, but it’s important for buyers to understand the nuance in these definitions.

Two of the most important acronyms to get right are AVOD and FAST.

Despite dozens of streamers, programmers and publishers crowding the space, AVOD and FAST are the only two ways to watch ad-supported TV beyond the set-top box.

The core difference between them comes down to content distribution. Streaming content can either be served on a one-to-many basis (as in live) or one-to-one basis (as in when you want it).

Free ad-supported TV (FAST) apps host linear channels that deliver scheduled programming to a mass audience through connected devices, while ad-supported video-on-demand (AVOD) is at the behest of the user, who initiates individual viewing sessions that generate inventory in which to serve personalized advertising.

The UX of AVOD vs. FAST

When someone signs into their ad-lite Paramount+ account, for example, they immediately have every episode of, say, MTV’s “Catfish” at their fingertips – as well as the burden of choice if they’re not in a “Catfish” sort of mood. That’s AVOD.

But if they decide to turn on Samsung TV Plus and sit back to watch whichever episode of “Hell’s Kitchen” happens to be on and do it for free, that’s known as a FAST experience.

AVOD isn’t the only VOD

Just to complicate matters, VOD has a bunch of subcategories.

AVOD is one, but there is also SVOD (subscription video-on-demand) and TVOD (transactional video-on-demand; think pay-per-view).

The best way to think about VOD is as an umbrella term to describe a “one-to-one relationship between the user and the server output,” said Mike Richter, VP of global revenue operations for CTV and digital at Trusted Media Brands.

Each variation of VOD signifies how the channel is monetized, whether that be with ads, subscriptions or with a one-off payment.

FAST, meanwhile, is a way “to describe linear scheduling in a connected TV nature,” Richter said.

Sounds good. But then, what the heck is a vMVPD?

The DL on vMVPDs

Virtual multichannel video programming distributors, known as vMVPDs for short, function just like FAST channels. YouTube TV and Sling TV are two classic examples.

They serve as a central hub for access to various linear networks and channels. The only difference is that vMVPDs require a subscription fee of sorts, whereas FAST is free. That’s what the “F” stands for.

“FAST is a subcategory of vMVPD, the same way CTV is a subcategory of OTT,” Richter said.

Is FAST linear, CTV or both?

Although all FAST channels (and vMVPDs for that matter) behave like linear addressable, there is still no consensus as to whether FAST should be classified as linear or CTV.

“FAST is the evolution of ad-supported streaming – which has been entirely on-demand until now – becoming the new linear [as in, accessible and free of charge],” said Justin Evans, global head of analytics and insights at Samsung Ads. “So, while it feels a lot like linear TV, it’s [still technically] CTV.”

But because of the core differences in business models, some TV industry experts say otherwise.

VOD is an “intentional use case, whereas linear is more accessible,” said Jeff Shultz, chief strategy and business development officer of streaming at Paramount. Shultz was previously the chief business officer of Pluto TV and joined ViacomCBS (then called Viacom and now called Paramount) after the broadcaster acquired Pluto in early 2019.

“You can draw a clear line between AVOD and FAST, and that line is linear,” Shultz said.

AVOD, by comparison, is all about CTV.

Behind the scenes

But because FAST emulates linear TV channel distribution, there are a few technical differences between FAST and VOD in terms of how ads are delivered.

Broadcast and legacy TV networks historically use a master control system, which is a technological hub that maintains the day’s TV broadcast schedule, including commercial spots.

“It’s like the CMS of television,” said IAB Tech Lab CEO Anthony Katsur, who previously served as SVP of digital strategy, corporate developers and ops at Nextstar Media Group.

The systemized schedule includes watermarks, standardly SCTE 35, which use audio cues to notate the right time for an ad break within content.

Although this system is native to linear TV delivery, it’s not exclusive. Other OTT channels can use it as a means to trigger a call for an ad. That’s what YouTube TV does, for example, Katsur said. For linear delivery through any device connected to an IP address, the audio cue is digitally inserted and triggers a “call” within the video ad-serving template (VAST) of the cable company or the broadcaster control systems.

But there’s no one standard for OTT ad delivery.

“Those breaks are [generally] triggered three or four minutes ahead of the actual spot running, which, in our industry, is an eternity,” Katsur said. “CTV publishers have a lot of flexibility now in terms of how to structure the VAST call.”

In other words, CTV publishers can trigger the call a lot sooner, and both FAST and AVOD publishers have that flexibility, although FAST tends to opt for a linear-inspired delivery model.

Although AVOD has become a cause célèbre – especially following recent news of Netflix’s plans to launch ads later this year – FAST has its advantages, too.

In fact, FAST channels might actually be yielding more user engagement, said Paramount’s Shultz, a Pluto TV vet. Pluto was one of the early pioneers of FAST.

Linear and linear-like channels are well-suited for episodic content that naturally leads to long, lean-back viewing sessions. Sometimes, Shultz said, viewers end up in “incredibly long session times” with content they came across entirely by accident.

Sometimes, he added, people also just need a break from the (21st-century/first-world) struggles of choosing what to watch.

“That’s why Pluto has continued to focus so much on FAST,” Shultz said. “It’s produced more engagement in terms of yielding more MAUs, total viewing hours and thus more revenue.”