Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Out Of Home, Out Of Mind?

Data-driven out-of-home media hasn’t taken off, in part, because most buyers don’t see it as a channel for generating mass reach and conversions.

But the fact that people don’t feel bombarded by ads in the world around them – at least when compared with the unutterable annoyance of ad clutter around the web – is actually part of the OOH pitch.

Still, advertisers have become accustomed to the promise of one-to-one targeting, and, without that capability, they’ve taken to planning one-off and relatively unambitious OOH campaigns. Think a travel company placing ads in airports and train stations or an energy drink targeting locations near gyms.

“We’ve seen time and time again that agencies steer their clients to poorly devised campaigns out of either a) ignorance b) laziness c) lack of data or d) all of the above,” writes Chris Gadek, VP of growth at the OOH demand-side platform AdQuick, in a blog post.

AdQuick’s solution, in keeping with its programmatic edge, is to remove human planners from the equation through a machine-learning-based campaign tool intended to replace domain experts and OOH agency planners.

“They’re doing their best,” Gadek writes of the purported OOH specialists, “but unfortunately their best is unacceptable in modern marketing.”

Cold Currents

Media investment analyst Brian Wieser poured cold water on alternative TV currencies during the CIMM Summit in New York this week.

As the term “currency” implies, everyone in the ad-buying chain must share the same valuation within a rating system. It’s technically possible to have additional currencies, Wieser says, but “it’s going to result in a lot of extra cost – and marketers don’t want to pay extra if they can avoid it.”

Besides, does the industry really need a replacement for panels and demos?

Advertisers buy TV ads to reach masses of people, so “I think many markets will continue to rely on age and gender,” Wieser says, going on to note: “I do think that Nielsen is durable.”

Agencies are a bulwark for Nielsen, too, he says, because they are slow to transact on new currencies.

Optimism exists, though, for those knee-deep in advanced video that are pining for something new. Buyers “on the ground” don’t share Wieser’s opinion, says Bharad Ramesh, executive director of research and investment analytics at GroupM, where Wieser worked as global president of business intelligence until January this year.

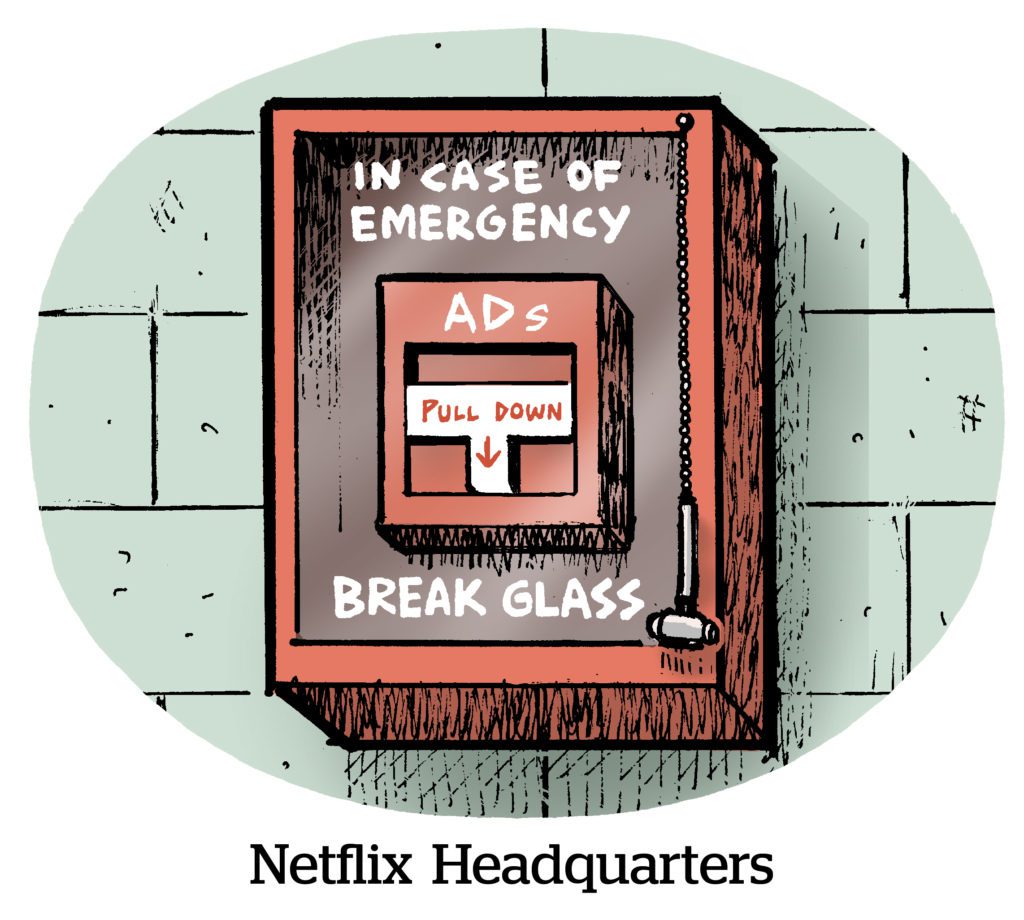

Netflix Ad Chill

The simple fact that Netflix is, well, Netflix, helps boost its advertising business. But with the ad group’s big ambitions and the company’s need for revenue, just being Netflix isn’t enough.

The company’s recent leadership shake-up, namely the departure of Jeremi Gorman and her replacement by Amy Reinhard as sales chief, is about creating greater urgency for the advertising group, The Information reports. As of June, Netflix’s ad sales and ad-supported subscription numbers were only roughly half of what the company projected they would be a year ago.

Netflix has been stingy in terms of its targeting options. There’s no user-level targeting and only very broad demographic or content-based targeting. Netflix also returns nothing in terms of audience or media info – like the shows advertisers ran on and what kind of account holders they reached.

The Netflix ad-supported tier has around 10 million subscribers so far, according to a source close to Netflix but not within the company, per The Information. But while 10 million might sound like a lot, it’s slim pickings by national TV broadcast standards.

But Wait, There’s More!

Nearly half the email and home address data used for programmatic targeting is simply wrong. [Ad Age]

A number of Google services and Cloud customers were targeted with a novel HTTP/2-based DDoS attack, which peaked in August. [blog]

Paramount adds iSpot as a TV currency partner. [Adweek]

WTF is traffic shaping? [Digiday]