Streaming TV and video ads didn’t fully deliver for Magnite this quarter, but the bloom isn’t off the CTV rose for the starry-eyed SSP.

CTV contributed $52.5 million to Magnite’s Q3 earnings, actually declining 6% from $56 million at the same time last year. CTV comprised 39% of overall revenue this quarter, compared to 41% for mobile ads and 20% for desktop ads.

Despite lower-than-anticipated revenues and “a soft start to Q4” due to anemic ad spend, CEO Michael Barrett told investors on Wednesday that he expects CTV revenue to grow faster in 2024.

Total Q3 revenue increased 3% YOY to $150.1 million.

Magnite stock was down by close to 3% Thursday morning.

Travel was Magnite’s strongest category, while weaker performers included retail, financial services and media and entertainment, due to the actors’ and writers’ strikes.

The CTV slowdown

The Hollywood strikes led to a “paucity of content,” Barrett said. For buyers interested in programmatic CTV campaigns, “there’s not any home to put them in to execute programmatically.” Media and entertainment ad spend was also down because of the strikes, because studios weren’t promoting shows and films.

Last year’s political ad spend also created difficult comps for CTV in both Q3 and Q4, according to CFO David Day. By the same token, though, the presidential election in 2024 could give CTV a boost.

Barrett’s CTV goals for 2024 include “a tighter stitching” of the SpringServe video ad server with Magnite’s programmatic platform and new features for ClearLine, a direct buying product for advertisers and agencies, that transfer linear TV dollars to CTV.

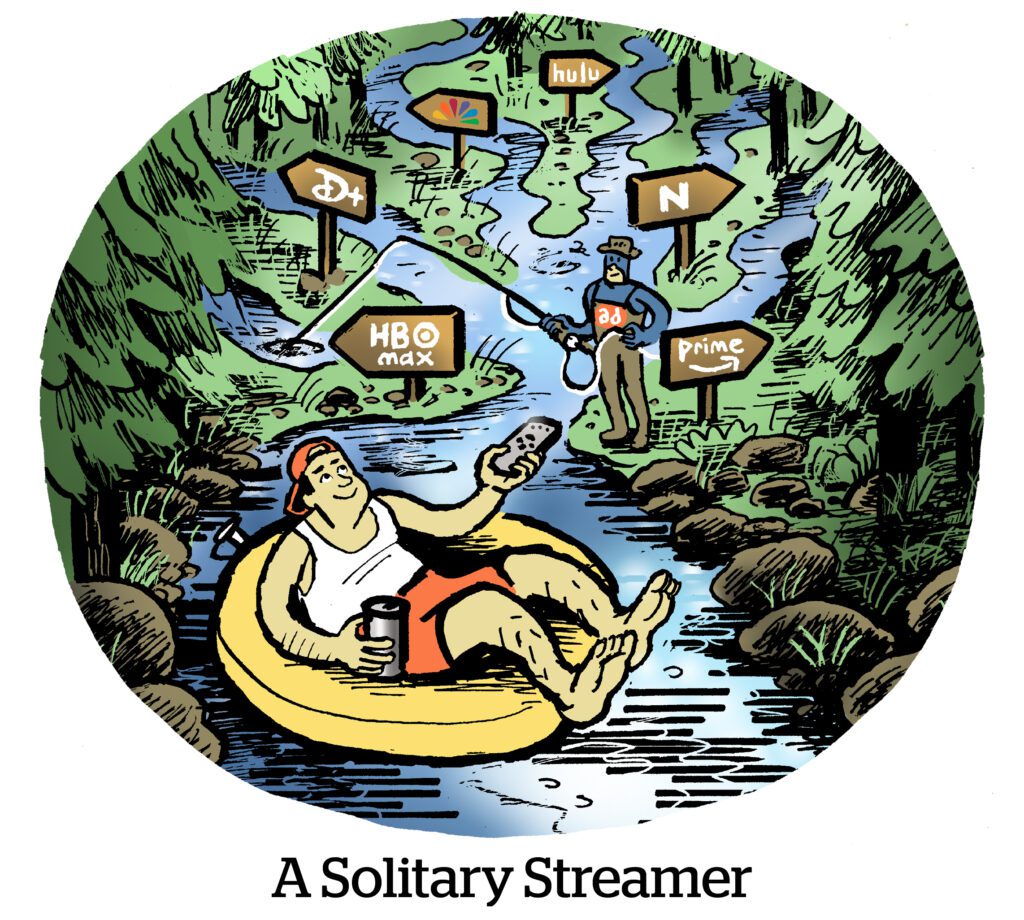

Programmatic CTV is still young, with relatively little ad-supported, on-demand video inventory. Many streamers and programmers also still sell programmatic deals through their direct sales teams, according to Barrett. But as Amazon Prime Video adds an ad-supported tier in 2024 and more major sports events go the livestreaming route, he said, premium CTV programmers may develop an appetite for programmatic.