The US ad market will be boring next year. In a good way.

After the pandemic weirdness of 2020, record ad spending in 2021, ugly comps in 2022 and relatively easy comps this year, US ad revenue will stabilize as we head into 2024 at a low single-digit growth rate, Brian Wieser predicts.

“The factors that supported unusual growth during the pandemic are not present anymore,” said Wieser, principal of Madison and Wall, the strategic advisory firm he launched earlier this year after leaving his role as GroupM’s lead analyst.

According to Wieser, the ad market will grow 6% in the third quarter, 8% in the fourth, then even out between 4% to 5% growth (excluding political advertising) next year to hit roughly $392 billion.

These numbers are in line with what GroupM and Magna are forecasting for the year ahead.

But if you double-click on Wieser’s numbers, there are several interesting – and somewhat disturbing – trends to note.

Linear’s slow decline

Consider the plight of national TV advertising.

Wieser believes national TV ad spending will decrease by 9% this year, by just 2.3% next year (thanks to the US presidential election) and by 4.8% in 2025.

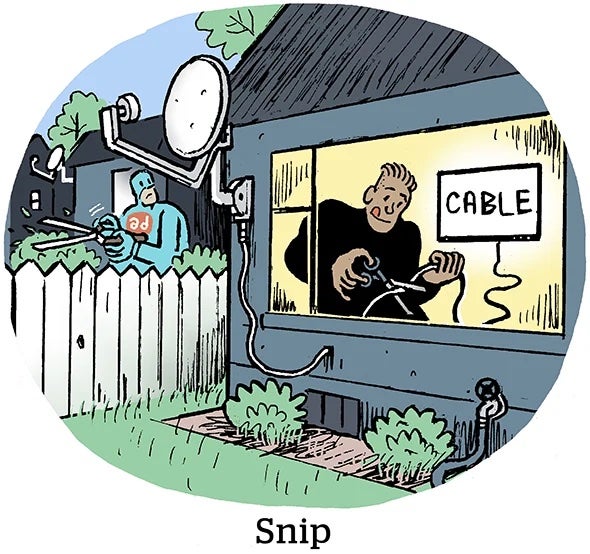

The reasons? Cord-cutting is on the rise, traditional TV networks are cannibalizing cable in favor of generating streaming subscriptions for services that often have no or very few ads and tense carriage disputes are putting even more pressure on pay TV bundles, as well as quashing the long-held belief that live sports is the glue (and the crown jewel) of cable TV.

Case in point: Disney-owned channels, including ESPN and ABC, are currently unavailable to Spectrum cable viewers (and have been since last week) due to a financial disagreement between the companies over contract fees.

But there are long-term consequences of these disputes beyond pay TV households missing out on college football or the US Open.

But there are long-term consequences of these disputes beyond pay TV households missing out on college football or the US Open.

If a deal isn’t reached (and in the interim, even if one is), anyone who wants to watch Disney TV network content will have to go the MVPD route. Disney is already using the conflict as an excuse to urge Spectrum subscribers to sign up for its Hulu + Live TV plan.

Overall viewing levels probably won’t change that much as a result. People who cut the cord aren’t moving to a cabin in the woods; they’re just not watching cable. But those audiences won’t be reachable at scale through television anymore.

Meanwhile, broadcasters are desperately wooing subscribers to their streaming services despite losing money on nearly every sub.

“Unfortunately, because of the way that TV network owners are positioning themselves,” Wieser said, “they’re doing their best to make sure they get a larger share of a shrinking pie.”

The publisher’s burden

Speaking of shrinking pies, the open internet’s share of ad revenue will remain relatively flat.

Wieser defines the open internet as any digital ad sales outside the walled gardens.

“The issue here is that when publishers don’t invest in their businesses anymore, it constrains the opportunity,” he said, “and we end up with a negligible growth rate rather than something that’s closer to the overall average for digital advertising.”

Take local journalism. Its death spiral greatly accelerated when publishers decided not to invest in local news, he said. Fewer stories means less ad inventory means fewer journalists means even fewer stories.

It’s the reverse flywheel from hell, and not unlike what’s been happening as broadcasters disinvest in linear TV on a relative basis, Wieser said.

“If networks put all of their expensive programming on streaming services,” he said, “nobody should be surprised if linear TV dies.”

But publishers that invest in growth, including legacy magazines and newspaper publishers, can stop the spiral.

“The open internet is never going to be as scalable as the ‘content-less’ platforms; search is still the greatest business ever,” Wieser said. “But the upside to a journalistic property is that they can still build durable brands.”

“The open internet is never going to be as scalable as the ‘content-less’ platforms; search is still the greatest business ever,” Wieser said. “But the upside to a journalistic property is that they can still build durable brands.”

Retail media to the rescue

Considering these shrinking pies and death spirals, what is driving that 4% to 5% growth Wieser foresees for next year?

Digital, of course – including search, social, YouTube, Apple and retail/commerce media, which will together make up a 64% share of all advertising.

Retail media, in particular, is set to go bananas, accounting for $42 billion in ad revenue this year.

To be fair, Amazon dominates the category, but this pie is large enough for others – including Instacart, Walmart, Criteo, et al. – to take decent-sized slices.

Also, retail media is only a slice of the larger pie that is commerce media, which houses everything from eBay and Uber to Expedia.com.

“Amazon is in the best position to capture retail media demand, but there’s a lot of room for other players,” Wieser said. “A lot of inventory is getting created in this space, and that makes it more of a growth area than any other category I can point to right now.”