2021 was brought to you by the letters M&A.

After a pandemic-induced lull in deal activity in 2020, last year was wall-to-wall consolidation across the media and marketing technology sectors.

Total deal-making activity in 2021 was up more than 82% year over year, according to LUMA’s 2021 market report released last week.

And you can expect more to come in 2022, said Conor McKenna, a director at LUMA.

“Based on the conversations we’re having and the announcements you’re already seeing in the market, it doesn’t feel like we’re slowing down anytime soon,” McKenna said.

The new year is less than two weeks old, and we’ve already seen acquisitions by Integral Ad Science (of French contextual advertising startup Context), Smartly.io (of London-based Google advertising specialist Ad-Lib.io) and Magnite (of cryptographic audience data startup Nth Party).

On Monday, T-Mobile acquired rideshare ad network Octopus Interactive.

The two main categories fueling deal activity

The majority of M&A happening across media, marketing and ad tech falls into six main buckets: mobile apps, data and identity, commerce media, audio, the ongoing maturation of the programmatic ecosystem and, of course, connected (or, as LUMA likes to refer to it, “convergent”) TV.

But it was mobile apps and CTV that spurred some of the biggest deals in 2021.

App attack

On the app front, “people finally came to realize that gaming is a huge space with massive growth that generates a ton of consumer attention,” McKenna said. “And a lot of that engagement is driven by ad-supported models.”

AppLovin is the most salient example of mobile ad tech making good. The company has been on a content-buying spree – (see its 2020 acquisition of Machine Zone) – and an ad tech buying spree.

AppLovin spent roughly $1 billion apiece in 2021 to acquire mobile measurement platform Adjust in February and mobile ad exchange MoPub from Twitter in October.

In the midst of all that deal activity, AppLovin went public in mid-April.

“We’re seeing mobile ad tech companies building themselves into massive entities and really starting to bulk up,” McKenna said.

In addition to AppLovin, ironSource went public in June, and Digital Turbine, already a public company, made three ad tech acquisitions in quick succession last year: AdColony in February followed by mobile DSP Appreciate and app monetization platform Fyber in March.

“Similar to CTV, the growth we’re seeing in the mobile app ecosystem is built on consumer trends that are not going away, which is creating a big opportunity in terms of advertising and monetization,” McKenna said. “The landscape also continues to shift, as we’ve seen with the IDFA, and when companies need to move quickly, they will often turn to M&A.”

CTV eats the world

The need to move quickly is also one of the main factors driving the breakneck pace of deal activity in the CTV ecosystem.

“SVOD, AVOD, FAST – however you want to cut it, CTV is growing rapidly, and a lot of that growth is accruing to the advertising side of things,” McKenna said.

Subscription video on demand (SVOD) generated a lot of the initial growth in streaming. But as CTV matures, subscription fatigue is leading to an embrace of ad-supported streaming content – and investors and analysts are taking notice, he said.

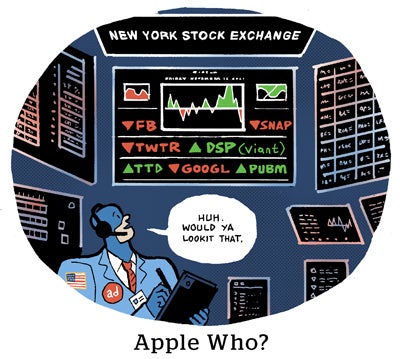

As ad tech companies hit the public market over the past year, “CTV became part of the required narrative,” McKenna said.

Which begs the question of whether some of the excitement around CTV is really just hype in disguise.

At the beginning of 2021, tech stocks were extremely frothy, and it was enough to simply mention “CTV” on an earnings call to bask in the channel’s reflected glow.

But that’s no longer the case, McKenna said. The market has started to grow up.

“Some of that shine and sheen you’d get just from saying ‘CTV’ without being able to back it up with results is over,” he said. “Companies have had three or four quarters to mature, investors have gotten smarter and analysts are asking the right questions – and so companies are being judged on their capabilities and their results rather than just talking to talk.”

And in order to get those capabilities quickly, public companies in particular are using their multiples to grow inorganically. Just look at Magnite, with its acquisitions of SpotX and SpringServe; Blackstone’s majority stake in Simpli.fi; and Integral Ad Science’s purchase of Publica.

“There’s still so much change on the horizon that we’re not even close to the end when it comes to CTV – and it’s still just a fraction of linear ad spend today,” McKenna said.