Television streamers and media companies are on the road to recovery after a pretty rough year.

Programmers have been fighting against macroeconomic constraints and the Hollywood writers’ and actors’ strikes, both of which reduced ad revenue growth over the course of this year. Now, programmers are starting to recover some of their losses.

Or at least that’s what last quarter’s earnings suggest for Disney, Paramount, Warner Bros. Discovery (WBD), Netflix and Roku. The common denominator: Ad revenue and subscriber growth are moving back in the right direction for programmers (though WBD lost subs).

Ad spend is recovering in certain brand verticals with more consistent consumer demand, such as consumer-packaged goods and health and wellness. Meanwhile, streamers are attracting new subscribers with new content for their services, like live sports and news, as well as bundles.

Dreaming about streaming

The actors’ strike, which came to a tentative deal on Thursday, still caused major delays to programming lineups. To circumvent that roadblock, media companies have diversified their content slates enough to bring in fresh subscribers.

Most programmers reported stable or renewed subscriber growth from varying their content selection last quarter compared with flat or declining numbers earlier in the year. As for WBD, some subscriber losses came from combining its two streaming services (HBO Max and Discovery+) into just one (Max), and from licensing many of its shows and films to other services – namely, Netflix.

And with renewed subscriber growth comes fresh ad demand.

Last quarter, streaming ad revenue jumped 29% YOY for WBD, 18% for Paramount and Roku, and 4% for Disney, although Roku combines revenue from ads and content distribution in its reporting. (Netflix still doesn’t disclose ad revenue: It’s not a material part of the business yet, according to company execs.) Average revenue per user is also ticking upward for media companies, as they receive an influx of digital ad dollars.

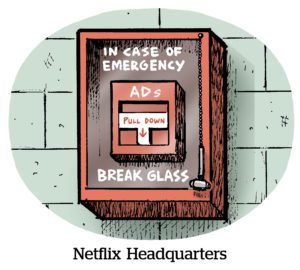

Netflix and Disney+, both of which launched ad-supported tiers late last year, are seeing momentum around sign-ups.

Netflix’s ad tier now has 15 million global subscribers (about 6% of its total subscriber base), while Disney+ with ads has about 5 million global subs (roughly 3% of its global accounts).

But Disney says its ad tier has stronger momentum right now. Over 50% of new Disney+ subs are signing up for ads, according to the company, whereas that number is just 30% for Netflix.

The full package

Another theme last quarter was bundling.

Streaming services are bundling more of their IP because a wider array of content reduces subscriber churn. Plus, bundles make it easier for advertisers to achieve inventory scale in one place.

Paramount rebranded its ad-free streaming service to Paramount+ with Showtime earlier this year, for example. And Disney confirmed it’s on track to combine Disney+ and Hulu content into a single app next year.

But the bundling trend goes beyond standalone streaming apps. The traditional pay TV bundle is also back in vogue, it seems.

Cable and satellite distributors want programmers to include their streaming inventory in pay TV packages to keep more people from cutting the cord. Content owners get to broaden their reach while raking in more ad revenue.

At least, that’s how the recent carriage dispute between Disney and Charter was settled.

Disney CEO Bob Iger called the company’s resolution with Charter – that Disney will allow streaming inventory in Spectrum’s most popular cable package – a “good deal for us.”

And other programmers are taking notice.

WBD CEO David Zaslav acknowledged the deal between Disney and Charter is “favorable for both parties.” And Paramount CEO Bob Bakish alluded to the same carriage agreement when he said, “It’s possible some of our [distribution] partners will more tightly integrate [streaming] into the pay TV bundle.”

Cheers to bringing back the bundle. 🥂